Urban Insights

Exploring the pulse of modern cities.

Virtual Item Economy: Where Digital Dreams Become Reality

Explore the fascinating world of virtual item economies and discover how digital dreams turn into reality! Unlock the secrets now!

Understanding the Virtual Item Economy: How Digital Assets Are Transforming Online Experiences

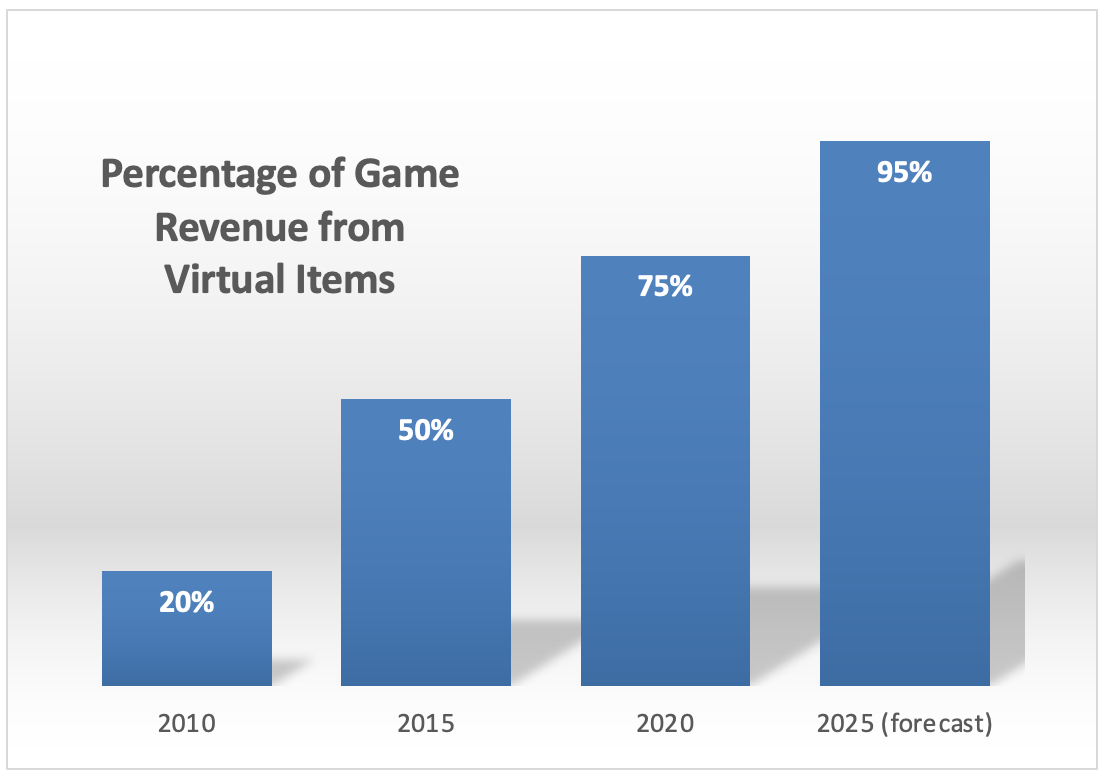

The virtual item economy has rapidly evolved, driven by the proliferation of online gaming, social media, and marketplaces for digital assets. In this digitized landscape, items such as skins, virtual currencies, and even avatars have become valuable commodities that players and users seek to acquire. According to reports, the global virtual goods market is projected to reach several billion dollars in the coming years, highlighting how crucial it is to understand the factors influencing this digital asset economy. These assets not only enhance the user experience, providing customization and personalization options, but they also represent a shift in how value is perceived and exchanged in online environments.

As the virtual item economy continues to grow, it is essential to recognize its impact on online interactions and lifestyles. Virtual goods are not just recreational items; they are transforming how communities form and engage. For instance, platforms that facilitate trading and purchasing virtual assets foster social connections among players, creating a sense of belonging and identity. Beyond gaming, businesses are embracing digital assets to enhance branding and consumer loyalty. Companies are leveraging these trends to weave narratives around their products, making the understanding of digital assets a fundamental aspect of modern marketing strategies, ultimately reshaping the future of online experiences.

Counter-Strike is a highly popular first-person shooter game that has captivated gamers since its release. Players can engage in various modes and maps, showcasing their skills in teamwork and strategy. To enhance your gaming experience, you can find great offers like the daddyskins promo code to get exclusive in-game items.

The Rise of Virtual Goods: Why They Matter in Today's Digital Marketplace

The rise of virtual goods has transformed the way we perceive ownership in the digital age. From in-game assets, such as skins and weapons, to digital collectibles like NFTs, these items are becoming an integral part of our online experience. According to a recent report, the global market for virtual goods is projected to surpass $190 billion by 2025, indicating a substantial shift in consumer behavior. As more individuals engage with digital platforms, the demand for virtual goods continues to grow, making them a critical component of today’s digital marketplace.

Understanding why virtual goods matter is essential for businesses aiming to thrive in this evolving landscape. Firstly, they offer users a sense of belonging and identity, allowing them to express themselves in virtual environments. Secondly, companies can monetize these goods through various channels, including microtransactions and subscription models. As digital ownership becomes increasingly valuable, brands that adapt to this trend not only enhance user engagement but also secure a competitive edge in a crowded market. Embracing the virtual goods phenomenon is no longer optional—it’s a necessity for future success.

Can Virtual Currency Replace Real Money? Exploring the Future of Digital Transactions

As we delve into the question of whether virtual currency can replace real money, it's clear that digital transactions are rapidly gaining traction. The rise of cryptocurrencies such as Bitcoin and Ethereum, combined with the increasing acceptance of digital wallets by consumers and businesses alike, suggests a significant shift in how we perceive value and currency. These virtual currencies offer advantages like faster transactions, lower fees, and enhanced security features compared to traditional banking methods. However, challenges remain, including regulatory hurdles, volatility in value, and public trust issues that must be addressed before a complete transition can occur.

Looking ahead, the future of digital transactions will likely be shaped by technology and consumer demand. Many experts predict that a hybrid model might emerge, where both virtual currency and cash coexist. For instance, government-backed digital currencies, also known as Central Bank Digital Currencies (CBDCs), could provide a stable alternative that mitigates the risks associated with decentralized cryptocurrencies. As more businesses integrate digital payment solutions and consumers adapt to these new forms of exchange, the idea of a cashless society may become a reality, fundamentally changing our economy and daily transactions.