Urban Insights

Exploring the pulse of modern cities.

Life Insurance: The Safety Net You Didn't Know You Needed

Discover why life insurance is the ultimate safety net for your loved ones and unlock peace of mind you never knew you needed!

Understanding Life Insurance: Key Benefits You Should Know

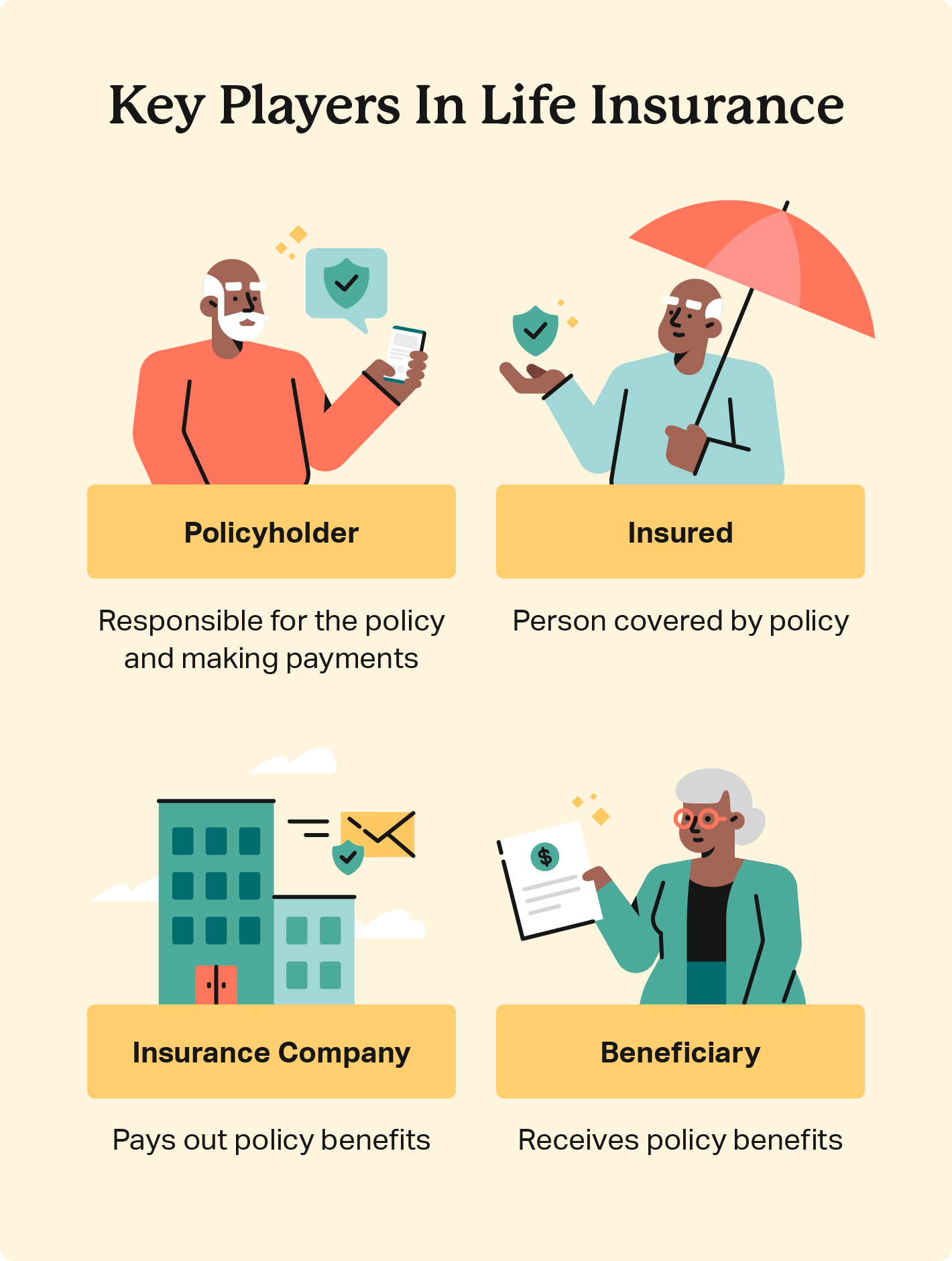

Understanding life insurance is crucial for anyone looking to secure their financial future and protect their loved ones. Life insurance provides a safety net that ensures your beneficiaries receive a predetermined sum of money in the event of your passing. This financial benefit can cover various expenses such as funeral costs, outstanding debts, and daily living expenses, easing the financial burden during difficult times. It's essential to recognize that there are several types of life insurance available, including term life, whole life, and universal life, each designed to meet different needs and preferences.

One of the key benefits of life insurance is the principle of financial security. By investing in a life insurance policy, you are essentially providing peace of mind for yourself and your family. In addition, life insurance can play a significant role in estate planning and wealth transfer, as the death benefit can be used to cover estate taxes or other liabilities after your passing. Furthermore, some policies may even build cash value over time, which can be accessed during your lifetime for emergencies or opportunities. Understanding these key benefits can help you make informed decisions about your financial future.

Is Life Insurance Really Necessary? Debunking Common Myths

When considering life insurance, many people are quick to dismiss it, believing it to be unnecessary. However, this common myth fails to recognize the true purpose of life insurance: providing financial security to your loved ones in the event of your untimely death. Without it, dependents may face overwhelming financial burdens, such as mortgage payments, educational expenses, or daily living costs. Thus, it becomes clear that life insurance can serve as a vital safety net, ensuring that your family's financial future remains stable.

Another prevalent misconception is that only the wealthy need life insurance. This assumption is misleading; even those with modest incomes can benefit significantly from coverage. In fact, according to various estimates, about 40% of households would struggle to meet their basic living expenses within six months of losing their primary breadwinner. This highlights the importance of having a life insurance policy in place, regardless of your financial status. It's crucial to evaluate your individual circumstances and consider how a life insurance policy can provide peace of mind for you and your family.

How to Choose the Right Life Insurance Policy for Your Needs

Choosing the right life insurance policy requires a thorough understanding of your personal and financial circumstances. Start by assessing your current financial situation, including income, debts, and dependents. Consider factors such as how much coverage you need to secure your family's future and whether you prefer a term or whole life insurance policy. A term policy typically offers lower premiums for a specified period, while a whole life policy provides lifelong coverage with a savings component but at a higher cost. Understanding these basic differences is crucial in making an informed decision.

Once you have a clear picture of what you need, it's essential to compare different policies and providers. Consider obtaining quotes from multiple insurance companies and reviewing their financial stability, customer service ratings, and claim settlement ratios. Moreover, it can be beneficial to consult with a licensed insurance agent who can guide you through the complexities of life insurance and help you tailor a policy that best fits your needs. To ensure you choose wisely, keep these key steps in mind:

- Assess your coverage requirements.

- Compare quotes and policy features.

- Consult with a professional if needed.