Urban Insights

Exploring the pulse of modern cities.

Pet Insurance: When Fido’s Fortune Becomes Your Financial Fumble

Discover how pet insurance can turn Fido's fortune into financial fumbles and learn to protect your wallet while keeping your furry friend safe!

Understanding Pet Insurance: Is It Worth the Cost?

Pet insurance can be a valuable safety net for pet owners, providing financial coverage for unexpected veterinary expenses. Understanding the various types of policies available is crucial in determining if it's worth the cost. Policies typically cover a range of incidents, from accidents and illnesses to preventive care, which can help mitigate the high costs of pet healthcare. However, potential policyholders should carefully evaluate their pet's needs, age, and health history, as these factors can significantly influence the overall cost and benefits of a pet insurance plan.

When considering pet insurance, it's essential to weigh the pros and cons. Here are a few key points to consider:

- Cost vs. Coverage: Assess how much you can afford to pay in premiums and whether the coverage aligns with your pet's potential medical needs.

- Peace of Mind: Having insurance can provide reassurance in times of crises, knowing that financial constraints will not hinder your pet’s treatment.

- Claim Process: Research the claims process of different providers to ensure ease of filing and reimbursement.

Ultimately, understanding pet insurance can help you make an informed decision about whether it’s worth the investment for your furry family member.

Top Reasons Your Pet Needs Insurance Before the Unexpected Strikes

Pet insurance is becoming increasingly essential for pet owners who want to ensure the well-being of their furry companions. Unexpected accidents or illnesses can lead to significant veterinary bills, often totaling thousands of dollars. By investing in pet insurance, you not only gain peace of mind but also the ability to make medical decisions based on your pet's needs rather than financial constraints. As a responsible pet owner, it’s important to consider that even routine vet visits can be expensive, and comprehensive coverage can help mitigate these costs.

Moreover, having pet insurance means that you will not have to hesitate before seeking veterinary care during emergencies. With policies that cover accidents, illnesses, and even routine check-ups, you'll be better prepared for the unexpected. It's crucial to remember that pets, like humans, can face sudden health issues, and early intervention is often the key to effective treatment. By securing insurance now, you protect your pet’s health and your financial stability, ensuring that when the unexpected strikes, you are ready to act promptly.

How to Choose the Right Pet Insurance Plan for Fido

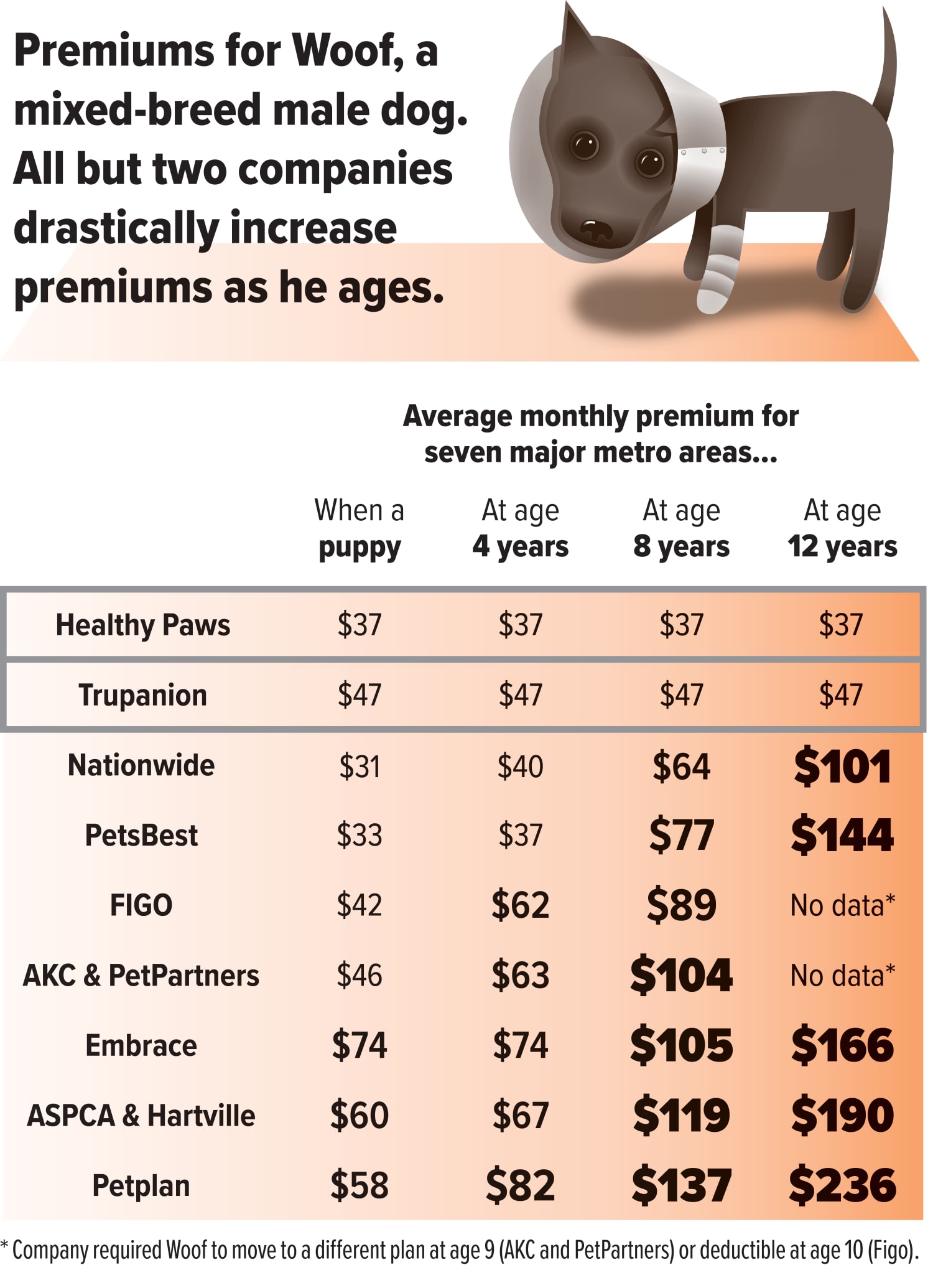

Choosing the right pet insurance plan for Fido can be a daunting task, but it’s essential for ensuring your furry friend receives the best care possible without breaking the bank. Start by evaluating your pet's specific needs based on their breed, age, and health history. Pet insurance policies typically come in several types, including accident-only coverage, comprehensive plans, and wellness packages. It's important to compare these options and consider factors such as monthly premiums, deductibles, and coverage limits.

Next, read the fine print carefully to understand what is and isn't covered by the policy. Many plans may exclude certain pre-existing conditions or offer limited payouts for hereditary issues. Additionally, look for reviews and ratings from other pet owners to gauge the reliability and customer service of the insurance provider. Prioritizing a policy that fits your budget and coverage needs can provide peace of mind knowing that you are prepared for any unexpected veterinary expenses for Fido.