Urban Insights

Exploring the pulse of modern cities.

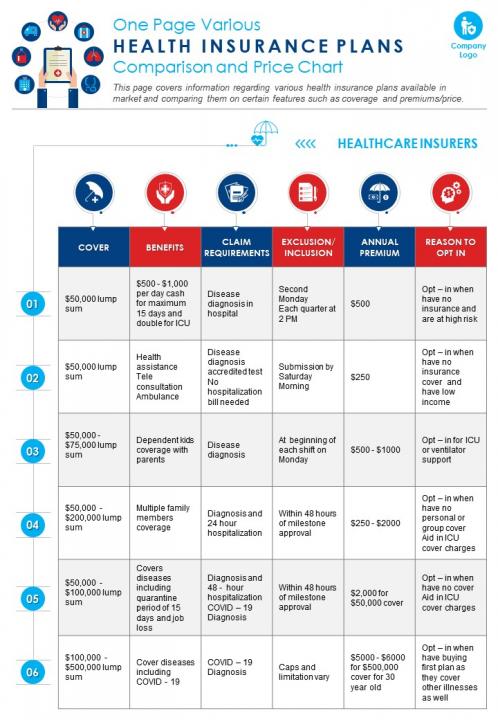

Insurance Showdown: Finding Your Perfect Match

Discover the ultimate guide to choosing the right insurance for you! Uncover secrets and tips in our Insurance Showdown. Click to find your match!

Understanding Different Types of Insurance: Which One Is Right for You?

When it comes to choosing the right insurance, it's crucial to understand the various types available. There are several categories of insurance, including health insurance, auto insurance, homeowners insurance, and life insurance. Each type serves a unique purpose and is designed to protect you from specific risks. For example, health insurance covers medical expenses, while auto insurance protects against vehicle-related incidents. To make an informed choice, consider your personal situation, needs, and the assets you want to protect.

To help you navigate the options, here are some key factors to consider when evaluating which insurance is right for you:

- Assess Your Needs: Determine what risks you face and which assets require coverage.

- Evaluate Your Budget: Understand how much you can afford to spend on premiums without compromising your financial stability.

- Research Coverage Options: Look into the different policies available and compare their coverage features.

- Consult an Expert: Consider speaking with an insurance agent who can guide you through your options and recommend tailored solutions.

Ultimately, the right insurance will provide you with peace of mind and financial security.

Top 5 Factors to Consider When Choosing Your Insurance Provider

Choosing the right insurance provider can significantly impact your financial security and peace of mind. When evaluating your options, it's essential to consider the financial stability of the provider. A company with strong financial backing is more likely to meet its obligations, ensuring that your claims will be honored. Look for organizations with a solid rating from independent rating agencies. This will give you confidence in their ability to handle your policy claims in the future.

Another crucial factor to consider is the quality of customer service provided by the insurance company. Reading customer reviews and ratings can give you insights into how responsive and helpful the company is. Additionally, examine their claims process—does it have a reputation for being straightforward and efficient? A reliable provider will make sure that you feel supported throughout your insurance journey, especially when it comes time to file a claim.

Insurance Myths Debunked: What You Really Need to Know Before Buying

When it comes to purchasing insurance, many consumers are influenced by myths that can lead to costly misunderstandings. For example, one common myth is that insurance is unnecessary if you are in good health or have a low-risk lifestyle. In reality, unforeseen events such as accidents or natural disasters can strike anyone at any time. To better understand the importance of having appropriate coverage, consider these key factors:

- Unexpected medical emergencies can arise regardless of your current health.

- Natural disasters can lead to significant property damage that isn’t always covered by standard policies.

- Lawsuits and liability claims can happen to anyone.

Another prevalent misunderstanding is that having the lowest premium is always the best option. While it might seem appealing to save money upfront, choosing an insurance policy solely based on cost can leave you underinsured, leading to financial strain in the event of a claim. It's essential to focus on coverage options and policy limits rather than just the price. Always read the fine print and consult with an insurance expert to determine the right policy to fit your needs. Ultimately, understanding the truth behind these myths can empower you to make informed decisions that protect your financial future.