Urban Insights

Exploring the pulse of modern cities.

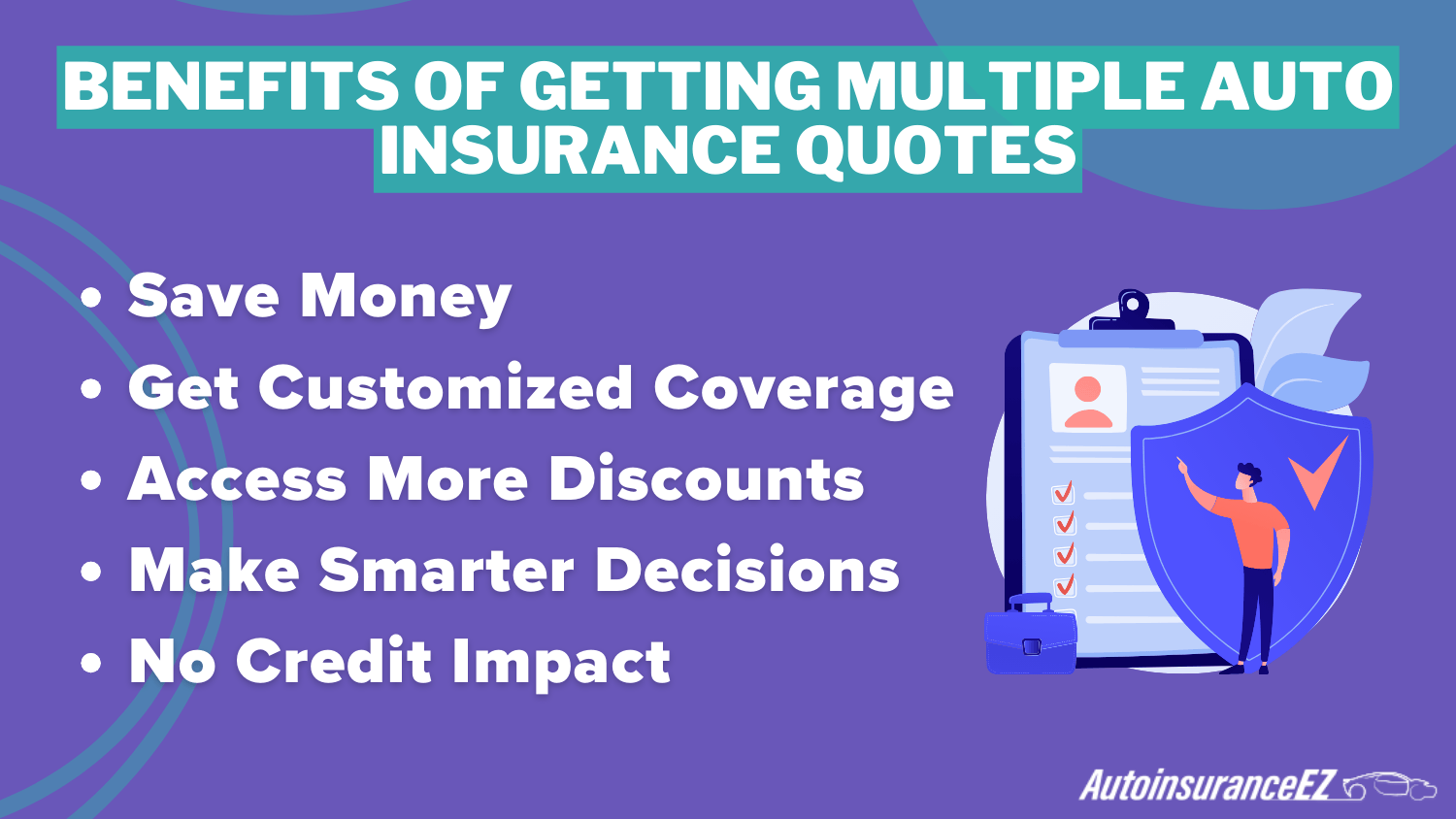

Quote Quest: Hunting for Insurance Bargains

Embark on a thrilling journey to uncover hidden insurance deals and save big! Join the Quote Quest today and discover your savings adventure!

Top 5 Tips for Finding the Best Insurance Quotes

Finding the best insurance quotes can save you a significant amount of money while ensuring you get the coverage you need. Here are top 5 tips to help you in your search:

- Compare Multiple Providers: Always get quotes from several insurance companies. Each company evaluates risk differently, leading to varying premiums for the same coverage.

- Utilize Online Tools: Leverage insurance comparison websites to easily compare rates and find the best deals within minutes.

- Consider Bundling: If you have multiple insurance needs, such as auto and home insurance, consider bundling them with the same provider for potential discounts.

In addition to these foundational strategies, it's important to pay attention to the details in your quotes. Read the Fine Print: Ensure you understand what is included in the policy and look out for any hidden fees. Additionally, ask for discounts—many insurers offer savings for safe driving records, loyalty, or even membership in certain organizations. By following these tips, you can ensure you're making informed decisions and finding the best insurance quotes available to you.

Understanding Insurance Policies: What to Look Out For

Understanding insurance policies can be a daunting task, especially given the various types available and the intricate wording often used. One of the first things to consider is the coverage limits. These limits define the maximum amount your insurer will pay in the event of a claim. It is crucial to assess whether the coverage limits align with your needs, particularly in areas such as health, auto, or home insurance. Additionally, be wary of any exclusions listed in the policy, which outline what is not covered, as this can significantly impact your financial protection.

Another essential aspect to examine is the deductible, which is the amount you must pay out-of-pocket before your insurance kicks in. Opting for a higher deductible can lower your premium costs, but it may also lead to substantial expenses in the event of a claim. Furthermore, familiarize yourself with the claims process. Understanding how to file a claim, the timeline involved, and the documentation required will save you headaches down the line. Keep these factors in mind to ensure you choose an insurance policy that best suits your circumstances and provides the necessary peace of mind.

How to Save Money on Your Insurance: A Comprehensive Guide

Saving money on your insurance can be a straightforward process if you take the time to review your policies regularly. Start by comparing quotes from multiple providers; this can often lead to significant savings. Websites that aggregate quotes can be particularly useful for this purpose. Additionally, consider bundling your insurance policies, such as home, auto, and life insurance, as many companies offer substantial discounts for bundled plans.

Another effective way to cut costs is to increase your deductibles. Higher deductibles usually result in lower premium payments, but ensure that you can comfortably afford the out-of-pocket expenses in case of a claim. Additionally, take advantage of available discounts; inquire about savings for factors like safe driving, low mileage, or features that enhance your home security. By strategically managing your insurance choices, you can enjoy better coverage while saving money.